For Premier Payroll Users, the Payroll Float account is used as a clearing account to record payroll transactions in the books. It facilitates the recording of various payroll transactions records and its balance is always expected to be zero at the end of any period. Any balances thereto shall be considered a reconciling item.

To better understand how payroll transactions affect the account, below are sample Journal Entries from different payroll transaction records. First screen shot shows a summary of journal entries from different transaction records when a payroll batch is committed for a direct deposit paycheck:

Notes:

a. The Funding Journal is a compound entry to record the fees and credit the bank for the total cash outlay. If the paycheck is not a direct deposit or a service printed paycheck, only the tax liabilities and payroll fees/charges are posted to the Payroll Float account and Net Pay is credited directly to the bank account. This can be viewed by clicking the link found on the payroll batch.

b. By default, The Funding Journal uses the same date (or today's date) when the payroll batch is committed so if the transactions are viewed from the Payroll Float register, make sure to filter the dates accordingly. (see Issue 131917 for reference)

Effect on Payroll Float if a paycheck is reversed

Timing is crucial in determining how reversals can affect the Payroll Float account:

1. If the direct deposit paycheck is reversed the same day or any day provided it is 2 days prior the check date and before the daily cut-off (2:00PM Pacific Time), the Payroll Float is zeroed out and the payroll liabilities are voided as well. This is also true for employer printed paychecks. The only difference is on the recording of net pay.

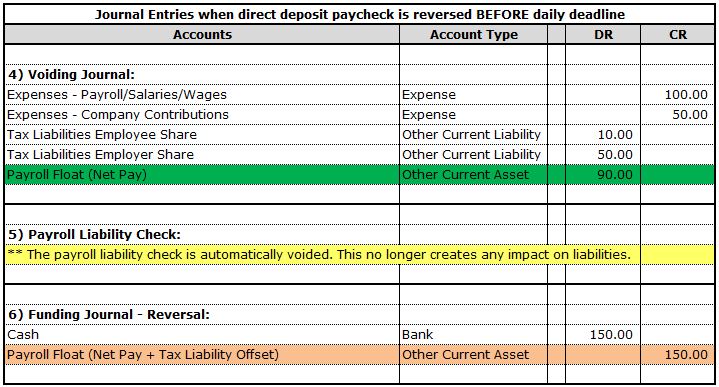

Further to the example above, see additional journal entries created upon reversal of a direct deposit paycheck before the daily deadline:

Notes:

a. As a result of the reversal, the liability check is automatically voided in the payroll module which either reduces or cancels funding of the payroll. The transaction record is kept but GL implications are removed.

b. Fees/Charges associated to the creation of the paycheck are not reversed.

2. On the other hand, if the direct deposit paycheck is reversed after the daily deadline, the only transaction record created is the voiding journal. As a result, the net pay of the reversed paycheck becomes a reconciling item on the Payroll Float account. In addition, payroll liabilities from the reversed paycheck also become reconciling items from the various liability accounts associated to the payroll tax items.

See screenshot below to further explain using the same example above:

Notes:

a. To reconcile the balance Payroll Float account as result of this reversal, users can create manual journal entry debiting cash and crediting the payroll float account. Ideally, this is done upon receipt of the funds from employee as refund of net pay. Alternatively, users can also create a Deposit transactions to record this by navigating to Transactions > Bank > Make Deposits and then select the Payroll Float account field from the Deposit tab.

b. For more detailed steps how to reconcile bank transactions in relation to refunds of taxes from paycheck reversals, see topic Reconcile Payroll Transactions Funding Account against Actual Funding per Bank Statement.

Related articles:

1. Creating a Payroll Reversal

2. Committing Payroll Reversals

3. Paycheck Reversal Considerations for Premier Payroll Users

4. Reconcile Payroll Transactions Funding Account against Actual Funding per Bank Statement

No comments:

Post a Comment